Dairyland Insurance often comes up in conversations when choosing the right insurance provider. With a rating of 8.2 out of 10, it is the 42nd-best insurance provider in our rankings. While it boasts a strong reputation and extensive availability, there are some areas where it needs to improve. Let’s dive into the details of Dairyland Insurance—its strengths, weaknesses, coverage options, and what sets it apart from the competition.

Pros and Cons of Dairyland Insurance

Pros

- Diverse Coverage Options: Whether motorcycles or off-road vehicles, Dairyland provides additional coverage options tailored to various needs.

- User-Friendly Website: The online experience is straightforward to navigate.

- Strong Ratings: Industry experts have given Dairyland high marks for its reputation and availability.

Cons

- Higher Costs: Dairyland’s insurance rates are notably more expensive than the national average.

- Limited Coverage Add-Ons: There are fewer optional add-ons than other providers.

Dairyland Insurance Ratings

Here’s a quick snapshot of Dairyland’s performance based on our review methodology:

- Overall Rating: 8.2

- Reputation: 8.6

- Availability: 9.2

- Coverage: 8.4

- Cost: 7.4

- Customer Experience: 8.0

These ratings reflect Dairyland’s performance across various factors, including reputation, coverage options, and cost-effectiveness.

Is Dairyland Insurance Good?

Founded: 1953

BBB Rating: A+

AM Best Rating: A+

Dairyland Insurance, based in Stevens Point, Wisconsin, has operated for over 70 years. It is known for offering insurance across 38 states and has been part of Sentry Insurance since 1966. While Dairyland holds strong ratings from AM Best and the Better Business Bureau (BBB), it is often seen as a viable option for those who might have difficulty securing insurance elsewhere due to poor driving records.

Dairyland may not be the top choice for most drivers due to its higher rates and less favourable customer service reviews.

Dairyland Customer Reviews

Customer feedback on Dairyland is mixed. According to the National Association of Insurance Commissioners (NAIC), Dairyland has a complaint index of 1.06, indicating a 6% higher complaint rate than the industry average.

BBB Ratings: Despite an A+ rating from the BBB, Dairyland has an average rating of 1 out of 5 stars from customer reviews. Common complaints involve issues with the claims process and poor customer service. Some reviews even mention disputes over claims that were not handled correctly.

Dairyland Insurance App Reviews

The Dairyland mobile app has received mixed reviews:

- Google Play: 3.9 stars

- App Store: 2.9 stars

The app’s ratings suggest room for improvement in user experience and functionality.

Dairyland Insurance Rates and Discounts

While exact rates for Dairyland’s policies aren’t readily available, we can use Sentry Insurance’s national averages to give a rough idea of Dairyland’s costs:

- Full-Coverage Monthly Average: $393

- Minimum Liability Monthly Average: $128

- Full-Coverage Annual Average: $4,712

- Minimum Liability Annual Average: $1,539

These rates are notably higher than the national averages of $2,681 for full coverage and $869 for minimum liability insurance.

Cost by Age:

- 16: $8,370 (Full Coverage), $4,011 (Minimum Coverage)

- 25: $5,051 (Full Coverage), $1,896 (Minimum Coverage)

- 35: $4,712 (Full Coverage), $1,551 (Minimum Coverage)

- 45: $3,971 (Full Coverage), $1,444 (Minimum Coverage)

- 55: $3,655 (Full Coverage), $1,328 (Minimum Coverage)

- 65: $3,773 (Full Coverage), $1,368 (Minimum Coverage)

- 75: $4,141 (Full Coverage), $1,495 (Minimum Coverage)

Dairyland’s rates can be competitive for high-risk drivers with speeding tickets, DUIs, or accidents on their records.

Discounts Offered:

- Multi-Car Discount: Savings for insuring more than one vehicle.

- Advanced Quote Discount: Discount for obtaining a quote in advance.

- Transfer Discount: Savings for switching from another provider.

- Payment Frequency Discount: Discounts for paying premiums less frequently.

- Homeowners Discount: Savings for having homeowners or renters insurance.

- Defensive Driving Discount: For completing a defensive driving course.

- Anti-Theft Discount: For using anti-theft devices.

Dairyland Coverage Options

Standard Coverage:

- Bodily Injury Liability: Covers medical expenses for others if you’re at fault in an accident.

- Property Damage Liability: Covers repairs for other vehicles you’ve damaged.

- Collision Insurance: Covers your vehicle in any accident.

- Comprehensive Insurance: Covers damage from environmental factors and theft.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages in no-fault states.

- Medical Payments Coverage (MedPay): This covers medical expenses for you and your passengers.

- Uninsured/Underinsured Motorist Coverage: Covers damages from drivers with inadequate insurance.

Additional Options:

- Special Equipment Coverage: For aftermarket parts.

- Towing Coverage: Helps with towing expenses.

- Rental Reimbursement: Covers rental car costs if your vehicle is out of commission.

- Lienholder Coverage: Covers costs if your vehicle is totalled before it’s paid off.

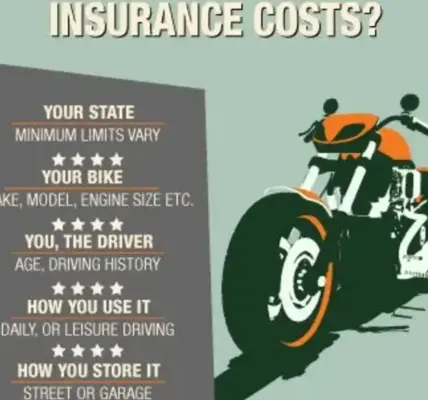

Motorcycle and Off-Road Insurance: Dairyland also offers coverage for motorcycles and off-road vehicles, including liability, collision, comprehensive, and speciality coverage options.

Final Thoughts

Dairyland Insurance has strengths, including various coverage options and discounts for various needs. However, higher costs and mixed customer feedback may make it less appealing for some drivers. Dairyland could be worth considering if you’re in a high-risk category or have specific insurance needs. For others, exploring other providers might offer better value or customer satisfaction.