As electric bikes (e-bikes) become increasingly popular, the need for proper insurance coverage has also grown. E-bikes offer a convenient and eco-friendly mode of transportation, but they also come with risks that can lead to costly repairs or medical bills. Understanding the nuances of e-bike insurance can help you protect your investment and ensure you’re adequately covered.

What is Electric Bike Insurance?

Electric bike insurance is a specialized type of coverage designed to protect your e-bike from various risks, including theft, damage, and liability. While some homeowners’ or renters’ insurance policies may offer limited bicycle coverage, they often need to catch up regarding e-bikes due to their higher value and motorized nature. Dedicated e-bike insurance policies provide more comprehensive coverage tailored to the unique needs of electric bike owners.

Why Do You Need Electric Bike Insurance?

While e-bikes are a fantastic way to navigate urban areas, they come with their own set of risks:

- Theft: E-bikes are a prime target for thieves due to their high value and easy resale. There may need to be more than standard locks and security measures to deter theft, making insurance a critical safety net.

- Accidents: Accidents can happen if you’re involved in a collision with another vehicle or a pedestrian. E-bike insurance can cover the costs of repairs or medical expenses, protecting you from significant out-of-pocket expenses.

- Liability: If you’re found at fault in an accident, you could be liable for damages or injuries. Your e-bike insurance policy’s liability coverage can protect you from lawsuits and financial strain.

What Does Electric Bike Insurance Cover?

E-bike insurance policies can vary, but they typically include the following coverage options:

- Theft and Vandalism: This coverage reimburses you if your e-bike is stolen or damaged due to vandalism.

- Accidental Damage: This covers repairs or replacement costs if your e-bike is damaged in an accident, whether with another vehicle or an object.

- Liability Coverage: Protects you from financial responsibility if you cause injury or damage to another person or their property while riding your e-bike.

- Personal Accident Coverage: Provides compensation for injuries you sustain while riding your e-bike, including medical expenses and sometimes lost wages.

- Worldwide Coverage: Some policies offer coverage for your e-bike even when traveling abroad, ensuring you’re protected no matter where you ride.

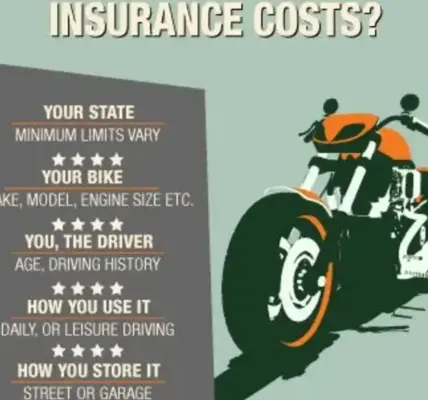

Factors That Influence Electric Bike Insurance Costs

The cost of e-bike insurance varies based on several factors:

- Value of the E-Bike: The more expensive your e-bike, the higher the premium. High-end models with advanced features and accessories typically cost more to insure.

- Location: Where you live can significantly impact your insurance premium. Urban areas with higher crime rates may lead to higher theft risks, increasing your premium.

- Riding Habits: How often and where you ride your e-bike can affect your insurance costs. Frequent riders or those who use their e-bike for commuting may face higher premiums due to increased risk exposure.

- Security Measures: Installing anti-theft devices, such as GPS trackers and heavy-duty locks, can lower your insurance premium by reducing the theft risk.

- Coverage Limits: The extent of coverage you choose will also impact the cost. Opting for higher coverage limits or additional coverage options will result in a higher premium.

How to Choose the Right Electric Bike Insurance

Selecting the right e-bike insurance policy requires careful consideration of your needs and budget. Here are some tips to help you make an informed decision:

- Assess Your Risks: Consider the risks you face as an e-bike owner, such as theft or frequent commuting, and choose a policy addressing these concerns.

- Compare Policies: Don’t settle for the first policy you find. Compare quotes and coverage options from multiple insurers to find the best value for your money.

- Check Exclusions: Be aware of any exclusions in your policy. Some policies may not cover certain types of damage, such as wear and tear, or may exclude coverage in specific locations.

- Consider Bundling: If you already have homeowners, renters, or auto insurance, check if your insurer offers discounts for bundling your e-bike insurance with other policies.

- Review the Claims Process: Understanding how to file a claim and how quickly claims are processed can save you headaches in an accident or theft.

Final Thoughts

Investing in electric bike insurance is a smart move for any e-bike owner. With the right coverage, you can enjoy the freedom of riding your e-bike without worrying about the financial consequences of theft, accidents, or liability. By carefully considering your coverage options and comparing policies, you can find an insurance plan that offers the protection you need at a price you can afford.